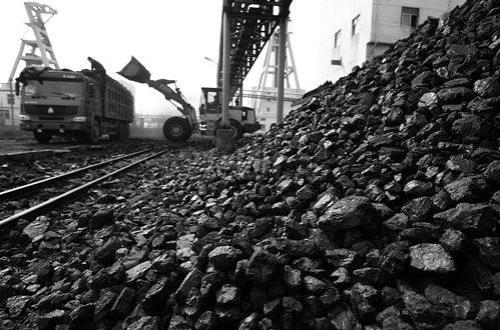

Imported 220 million tons of iron ore in the first quarter

According to the latest statistics from the General Administration of Customs, domestic iron ore imports reached 220 million tons in the first quarter of this year, an increase of nearly 20% year-on-year, setting a new record. The imported iron ore cost 172 billion yuan. At present, the port inventory is as high as 110 million tons. Indoor LED Light Box,LED Slim Light Box,LED Commercial Light Box,Indoor LED Frameless Light Box SHENZHEN YGHQ Optoelectronics Co.,ltd. , https://www.leds-smd.com

The data also showed that in March, China imported 73.96 million tons of iron ore and its concentrates, an increase of 12.72 million tons from the previous month, an increase of 14.58%; from January to March, it had imported 22.201 million tons of iron ore and its concentrates. The year-on-year increase was 19.4% and the average import price was 781.9 yuan per ton, down 8% year-on-year.

Renewing the historically high import scale of iron ore and highlighting the confidence of the steel mills that they must not stop production, because the average debt ratio of domestic steel enterprises has reached 70%. Once the production is stopped, steel mills face a substantial increase in the risk of bank debt waiver. However, since March, the consumer side has gradually improved, but also worthy of attention.

Exports of steel products have risen sharply. According to data from the General Administration of Customs, in March 2014, China exported 6.76 million tons of steel, an increase of 1.96 million tons from the previous month, an increase of 28.03% year-on-year; from January to March, steel exports totaled 18.33 million tons, a year-on-year increase of 27%. At the same time, the coke raw material export market continues to maintain its strong momentum. In March, China exported 650,000 tons of coke, an increase of 100,000 tons from the previous month. From January to March, it exported 1.94 million tons of coke, an increase of 615.6% year-on-year.

The latest data from the China Iron and Steel Association yesterday also showed that in late March, the ending stocks of key steel enterprises were 15.42 million tons, a decrease of 1.619 million tons from the end of the previous period and a decrease of 9.5% from the previous period. Inventories of steel enterprises fell by 1.619 million tons in the past ten years, and this destocking effort set a new record. Correspondingly, the social stock of the steel market has dropped for 5 weeks, and after the steel market price hit a historic low since 2009 in March, there has been a full rebound recently.

“The long-term demand for domestic steel products will remain very strong. In particular, at present, China’s steel construction accounts for less than 5% of all buildings. Compared with the proportion of developed countries that exceed 50%, there will be huge room for growth in the future.†Domestic large-scale steel structure residential Industrialization promoters and leaders - relevant person in charge of Hangxiao Steel Group expressed to the Securities Times reporter. Public statistics show that China's construction steel structure industry has formed a huge industry, and the output value of the main steel structure manufacturing industry alone exceeds 60 billion yuan.

However, the port's inventories of over 100 million tons make it difficult for analysts to be optimistic about the short-term trend. According to the data, as of the end of March, the inventory of imported iron ore in the country reached 110 million tons, a year-on-year increase of 64.3%, setting a record high. From the perspective of price trends, the price of imported iron ore with 62% grade dry basis powder has dropped from US$133/ton at the beginning of the year to US$115.24/ton on April 8.

Yang Rongfa, deputy editor of Platts' raw materials for iron and steel materials, told the Securities Times that although the port of China has a stock of over 100 million tons, the spot price of iron ore and its price have not dropped further.

One of the important reasons, he said, was that traders gradually withdrew from the market, and more than 60% of the port's spot was owned by steel companies and cash purchases. A phenomenon that deserves special attention is that the share of steel mills buying in swaps and markets has begun to increase because of the small amount of funds used, which is also an important reason why prices remain high.